Grand Music Launch Of The Upcoming Film LOVE KARU YAAA SHAADI Produced By Happyzon Telefilms & Auro Film Production

Posted by admin on Dec 5th, 2023 | Comments Off on Grand Music Launch Of The Upcoming Film LOVE KARU YAAA SHAADI Produced By Happyzon Telefilms & Auro Film Production

Posted by admin on Dec 5th, 2023 | Comments Off on Grand Music Launch Of The Upcoming Film LOVE KARU YAAA SHAADI Produced By Happyzon Telefilms & Auro Film Production

Mumbai, 2nd Dec, 2023 – Director-Producer Jaiprakkash Shaw orchestrated a dazzling affair at the Grand Music Launch of the upcoming film ‘Love Karu Yaaa Shaadi’ produced by Happyzon Telefilms & Auro Film Production. The spotlight shone on the much-anticipated songs “Wedding Da Season” and “Petha Agre Ka,” enchantingly composed by SLF and penned by the prolific Shabbir Ahmed.

A star-studded ensemble, including the film’s debutant actors Akarsh Alagh, Misha Kapoor, Mairina Singh, and Prity Singhania, took center stage. Adding allure to the event were the stunning performers of the film’s item song, Kinnari Dama and Preeti Goswami, whose presence added an extra layer of glamour to the celebration.

Ace Choreographer Shabina Kkhan’s magic was palpable as the dance sequences unfolded, accompanied by the melodious voices of Swati Sharma, Pranav Singhal, Pawni Pandey, and Mellow D, who lent their vocals to the soul-stirring tracks.

The star-studded affair also saw the presence of industry veterans and actors, including Ali Asgar, Govind Namdev, Garima Agarwal, Happy Sharma, Manoj Bakshi, and music composer Sanddep Nath. Media representatives were treated to an exclusive screening of both songs, immersing themselves in the rhythm and energy of the compositions.

Director-Producer Jaiprakkash Shaw expressed, “I have always believed in mentoring and introducing new talents in my films. This project is a testament to the amalgamation of modern thinking with traditional cultures, weaving a narrative that resonates emotionally with audiences. The film, from its storyline to its soulful music, connects with the heartstrings of every viewer.”

The media and audience alike have showered immense appreciation on both songs, predicting them to be the season’s biggest wedding hits. ‘Love Karu Yaaa Shaadi’ promises to be a cinematic symphony that transcends boundaries, capturing the essence of love and celebration.

Grand Music Launch Of The Upcoming Film LOVE KARU YAAA SHAADI Produced By Happyzon Telefilms & Auro Film Production

The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Posted by admin on Dec 5th, 2023 | Comments Off on The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Posted by admin on Dec 5th, 2023 | Comments Off on The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Tax planning is a crucial aspect of running a successful business. For startups and entrepreneurs, understanding the intricacies of tax laws and regulations can make a significant difference in their financial health and overall success. In this article, we will explore the importance of tax planning for startups and entrepreneurs, including how it can help in fund raising, business planning, and navigating the complexities of the tax system.

* The Role of Tax Planning in Fundraising

When it comes to raising funds for your startup, having a solid tax plan in place can greatly enhance your chances of success. Investors and lenders often require a clear understanding of the financial aspects of your business, including its tax obligations. By demonstrating your tax planning strategies, you can instill confidence in potential investors and lenders, showing them that you have a comprehensive plan to manage and optimize your tax liabilities.

A well-crafted tax plan can also help you determine the amount of funding you need and how it will be allocated. By considering the potential tax implications of different funding scenarios, you can make informed decisions about debt financing, equity financing, or a combination of both. This level of financial foresight can impress potential investors and provide them with the assurance that their investment will be utilized effectively.

* Incorporating Tax Planning into Business Planning

A business plan is a roadmap that outlines your vision, goals, and strategies for success. It is essential to include tax planning as an integral part of your business plan. By doing so, you can ensure that your financial projections accurately reflect your tax obligations and that you have allocated sufficient resources to meet those obligations.

When developing your business plan, consider the tax implications of different business structures. For example, forming a limited liability company (LLC) or a corporation can provide certain tax advantages and asset protection. On the other hand, a sole proprietorship may be simpler to set up but could expose you to personal liability for business debts.

Additionally, tax planning should be incorporated into your sales and pricing strategies. Understanding the tax implications of different pricing models and sales channels can help you optimize your revenue and profitability. By factoring in taxes from the outset, you can avoid surprises and ensure that your pricing strategy aligns with your overall financial goals.

* Navigating the Complexities of the Tax System

The tax system can be complex and ever-changing, making it challenging for startups and entrepreneurs to stay compliant and maximize tax savings. Engaging with tax professionals who specialize in working with startups and entrepreneurs can provide invaluable guidance and support.

Tax professionals can help you identify eligible tax credits, deductions, and incentives specific to your industry and business activities. They can also assist in structuring your business transactions and operations in a tax-efficient manner. By staying informed about the latest tax regulations and leveraging expert advice, you can minimize your tax burden while remaining in full compliance with the law.

* Goods and Services Tax (GST) Considerations

For startups and entrepreneurs involved in the sale of goods or services, understanding the implications of Goods and Services Tax (GST) is essential. GST is a value-added tax levied on most goods and services sold for domestic consumption. It is crucial to determine whether your business is required to register for GST and comply with its reporting and payment obligations.

Proper GST planning involves understanding the thresholds for registration, the applicability of different GST rates, and the availability of input tax credits. Failing to comply with GST regulations can result in penalties and reputational damage. Therefore, it is vital to stay informed about your GST obligations and seek professional advice when necessary.

Conclusion –

Tax planning is a critical aspect of running a successful startup or entrepreneurial venture. By incorporating tax planning into your fundraising efforts, business planning, and overall financial strategy, you can optimize your tax liabilities, minimize risks, and position your business for long-term success.

Remember to seek the guidance of tax professionals who specialize in working with startups and entrepreneurs. They can provide the expertise and support needed to navigate the complexities of the tax system, ensure compliance, and identify opportunities for tax savings. With proper tax planning, you can focus on growing your business and achieving your entrepreneurial goals with confidence.

For more detail Visit: www.cadunia.com

The Importance Of Tax Planning For Startups And Entrepreneurs By CA DUNIA

Jashn Agnihotri Her Journey From Air Hostess To Filmdom

Posted by admin on Dec 3rd, 2023 | Comments Off on Jashn Agnihotri Her Journey From Air Hostess To Filmdom

Posted by admin on Dec 3rd, 2023 | Comments Off on Jashn Agnihotri Her Journey From Air Hostess To Filmdom

Jashn Agnihotri is a model and actress. She has worked in many Punjabi films, TV and print advertisements, webseries and Hindi films and is doing many more projects. She has worked in many music albums. Recently, she was also seen in a music album with actor Shreyas Talpade. She shared her experience of working with Shreyas Talpade that he is a greatly skilled actor, he does not require many retakes and he is also expert in his work. It was a pleasure to work with such an experienced actor and learn new things from him.

Jashn Agnihotri has appeared in a song of Madhur Bhandarkar’s film Indu Sarkar.

Her Hindi film ‘Kaisi Yeh Dor’ is going to be released soon. The trailer of the film has been launched. This is a film that understands the true meaning of relationships and family. Jashn’s character is playing the lead in this film. At the beginning of the film she is a bubbly, happy-go-lucky kind of a person. This film is based on a small town and in the ups and downs of the film’s story, there is a change in her personality and in the end she becomes evolved and serious. There are many shades in her character. The film has been shot in Uttar Pradesh and Maharashtra. The shooting of the film took place during peak winter season in UP which was not very easy yet very exciting .

Before coming into the film industry, Jashn was an air hostess and used to travel from Delhi to Mumbai on flights. Jashn Agnihotri tells that she never thought that she would one day become a part of the film industry but fate pulled her in this direction. She belongs to Delhi and was working as an air hostess when people from film industry on a flight from Delhi to Mumbai suggested her to try her luck in acting. She liked the suggestion and came to Mumbai and gave a few auditions. She liked Mayanagari very much and after some time she decided to stay here and become a part of it, at first taking baby steps into modeling and then finally acting. Jashan loves watching films, reading and learning new things and languages. Her favorite actors are Shahrukh Khan and Aamir Khan. She has received Best Actress Award for the Punjabi film ‘Thappa’. She has also received the Indu US Cultural Ambassador award. She has many awards in her list of awards.

Jashn says that films influence people in a big way & that they have an impact on people’s lives in some way or the other. Therefore, she wants to do films which give a good message to the people and impact their lives positively .

Jashn says that people are moving away from their family and culture. Earlier it was so pleasant to live in a joint family, people were bound by their traditions and culture, but now everyone is moving away from their loved ones and their culture. A person should never forget the importance of his roots. External appearances are just an illusion which will fade away one day.

Jashn Agnihotri Her Journey From Air Hostess To Filmdom

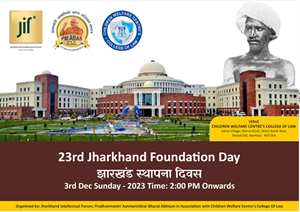

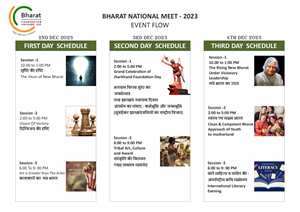

BHARAT NATIONAL NEET 23 A Grand 3 Day Event in form of JANAJATIYA GAURAV DIVAS is being organized on 2nd, 3rd and 4th of December in Malad West.

Posted by admin on Dec 3rd, 2023 | Comments Off on BHARAT NATIONAL NEET 23 A Grand 3 Day Event in form of JANAJATIYA GAURAV DIVAS is being organized on 2nd, 3rd and 4th of December in Malad West.

Posted by admin on Dec 3rd, 2023 | Comments Off on BHARAT NATIONAL NEET 23 A Grand 3 Day Event in form of JANAJATIYA GAURAV DIVAS is being organized on 2nd, 3rd and 4th of December in Malad West.

This Event is attributed to the Memory of Dharti Aaba Bhagwan Birsa Munda.

This Event is Organized by PRADHANMANTRI ATMANIRBHAR BHARAT ABHIYAN SANGHATHAN Presented by CHILDREN WELFARE CENTRE COLLEGE OF LAW.

Prominant Personalities and Speakers who are proficient in their respective fields will participate in this National Debate on how our Country of BHARAT is marching towards the destination of a Progressive Nation and how every Citizen can contribute their bit to the acceleration and prosperity of our Nation and how we collectively can give momentum to strengthen the Leadership of our Prime Minister Shri Narendra Modiji who has a vision to also take together the Janajatia Community of Bharat in this March of Progress. The Janajatiya Community has a significant role in the Freedom Movement of Our Country.

Unity in Diversity has always been our Countrys Forte and we do have several challenges to be met. This thought process will prove a guideline to the younger Generation of our Nation is the thought of the National Spokesperson of Shri PREM KUMAR of PRADHANMANTRI ATMANIRBHAR BHARAT ABHIYAN SANGHATHAN.

With this Event we will begin with providing a platform for the younger generation of our Country to which we look forward with lots of hope and expectation. Our Country of BHARAT will not only become MAHASHAKTI but will prove to be a MAHASATTA in this Mission of LEAD BHARAT 2036.

The Foundation is to be built by the entire Nation and the time is NOW, feels Prem kumar. Mumbai North Member of Parliament Shri Gopal Shetty ji is the Chief Guest of this Event who will speak his mind and give guidelines to us all.

Renouned Educationist, Social Worker, National Activist and Founder Trustee of Children Welfare Centres College of Law Shri Ajay Kaul ji, Shri Prashant Kashid, Pradhanmantri Atmanirbhar Bharat Abhiyan Sanghathan National President Shri Mukesh Sharma, Working President Shri Ramkumar Pal, Secretary Shri Bhavesh Joshi, Social Activist Sundari Thakur, Advocate Bindu Dube, BJP Leader Manoj Kumar Singh, International Rock Painter Shri Subodh Nemlekar , Businessman Shri Pawan Kumar, Journalist Shri Arun Lal , Businessman Shri Chand Seth, Educationist Shri Shamsher Rahi, Businessman and Social Activist Shri Pankaj Soni, Advocate Akhilesh Dube and Advocate Shri V K Dubey, Dr. Amulya Sahu and others of the National Team has collectively attributed to the fulfillment of this National Event.

We are proud that The Chief Guest of Honour for this National Event is Graced by Nationally Renouned PIL MAN OF INDIA Shri ASHWINI KUMAR UPADHYAY who is the Supreme Court of INDIA Lawyer.

LODHA FOUNDATION Founder Smt. MANJU LODHA, Renowned Shri KRISHNA PRAKASH, IPS, ADG, MAHARASHTRA who is also Crowned with the Title of IRON MAN and ULTRA MAN Internationally, ADVOCATE, Shri PUNEET CHATURVEDI, Shri DEEPAK PANDEY, I.G MAHARASHTRA, BHAJAN SAMRAT ANUP JALOTA, ENTERPRENUERAL BJP LEADER SHWETA SHALINI and many such personalities will grace the Occasion.

BHARAT NATIONAL NEET 23 A Grand 3 Day Event in form of JANAJATIYA GAURAV DIVAS is being organized on 2nd, 3rd and 4th of December in Malad West.

Cheetahjkd Celebrates Bruce Lee 83rd Birth Anniversary With Commando Hero Prem Parrijaa & Ashok Beniwal Dedicated To Educate Under Fc Privileged Children And Awareness On “No To Drug”

Posted by admin on Dec 3rd, 2023 | Comments Off on Cheetahjkd Celebrates Bruce Lee 83rd Birth Anniversary With Commando Hero Prem Parrijaa & Ashok Beniwal Dedicated To Educate Under Fc Privileged Children And Awareness On “No To Drug”

Posted by admin on Dec 3rd, 2023 | Comments Off on Cheetahjkd Celebrates Bruce Lee 83rd Birth Anniversary With Commando Hero Prem Parrijaa & Ashok Beniwal Dedicated To Educate Under Fc Privileged Children And Awareness On “No To Drug”

Cheetah Yajnesh Shetty, Rakesh Anna Shetty & Dr Harish Bhujanga Shetty with galaxy of movie stars were present in this occasion 27th Nov. 2023 at Celebration Club at Lokhandwala Andheri. There is ChitahJKD celebrated 15th National Championship”. Sh. Shagoon Wagh enlighted the lamp. Shri Vithal Shetty Foundation Trophy” presented to the top 3 winners, awareness programe on” No to drug” in presence of Dr Harish Bhujanga Shetty “Governing Council National Institute of Social Defense , Ministry of Social Justice & Empowerment Govt of India .

Associate partner Rakesh Anna Shetty of Shri Vithal shetty Foundation is helping in educating under privileged children, supported by Kartik Kider.

Bollywood’s well-known Martial Arts Guru and Best Film Action Choreographer of the Decade Dr.Cheetah Yajnesh Shetty has also been honored with the degree of ‘Doctorate of Philanthropy (PhD) in Martial Arts Pure Science’ by the ‘Global Martial Arts University Grant Commission’. Cheetah Yajnesh Shetty has till now given martial arts training to more than 150 Bollywood stars and about 10 lakh women.

Cheetahjkd Celebrates Bruce Lee 83rd Birth Anniversary With Commando Hero Prem Parrijaa & Ashok Beniwal Dedicated To Educate Under Fc Privileged Children And Awareness On “No To Drug”